Meela for Companies.

- For all employees: Offer mental health support to your entire workforce.

- Pay per use: Only pay for the services used, ensuring cost efficiency.

- Good employer brand: Show that you prioritize employee well-being.

- Better productivity: Improve mental health and see the positive impact on overall productivity.

- Reduce sick leave: By providing timely mental health support, you can reduce employee sick leave, benefiting both your workforce and business operations.

Meela for Insurance Partners.

- Reduce claim cost payouts: Help policyholders receive the right care quickly, reducing costly claims.

- Fast help: Immediate access to therapy services for policyholders.

- Right therapists: Our data-driven approach ensures each individual is matched with the right therapist for their needs.

- Safe tech and smooth integration: Meela offers secure technology solutions with seamless integration into your existing processes.

- Improving health outcomes: By reducing disability claims, you enhance both mental and physical health outcomes for your customers.

Contact us

Flexible care

Broad coverage across the country: We offer extensive coverage, providing access to mental health care across all regions.

Digital and physical sessions: Individuals can choose between digital and in-person therapy sessions, depending on their preferences and needs. Users can easily switch between digital and physical therapy, providing seamless care that fits their lifestyle.

Research-based matching: At Meela, we focus on research-driven care by optimizing the therapeutic alliance between patients and therapists. Our advanced dataset enables accurate predictions of the most effective treatment methods, ensuring individuals receive the right care from the start. This leads to quicker results, reduced disability claims, and improved overall health outcomes.

Transparent Pricing: With Meela, you only pay for what you use. We prioritize transparency and aim to build long-term partnerships that benefit everyone; your employees, policyholders, your organization, and your bottom line.

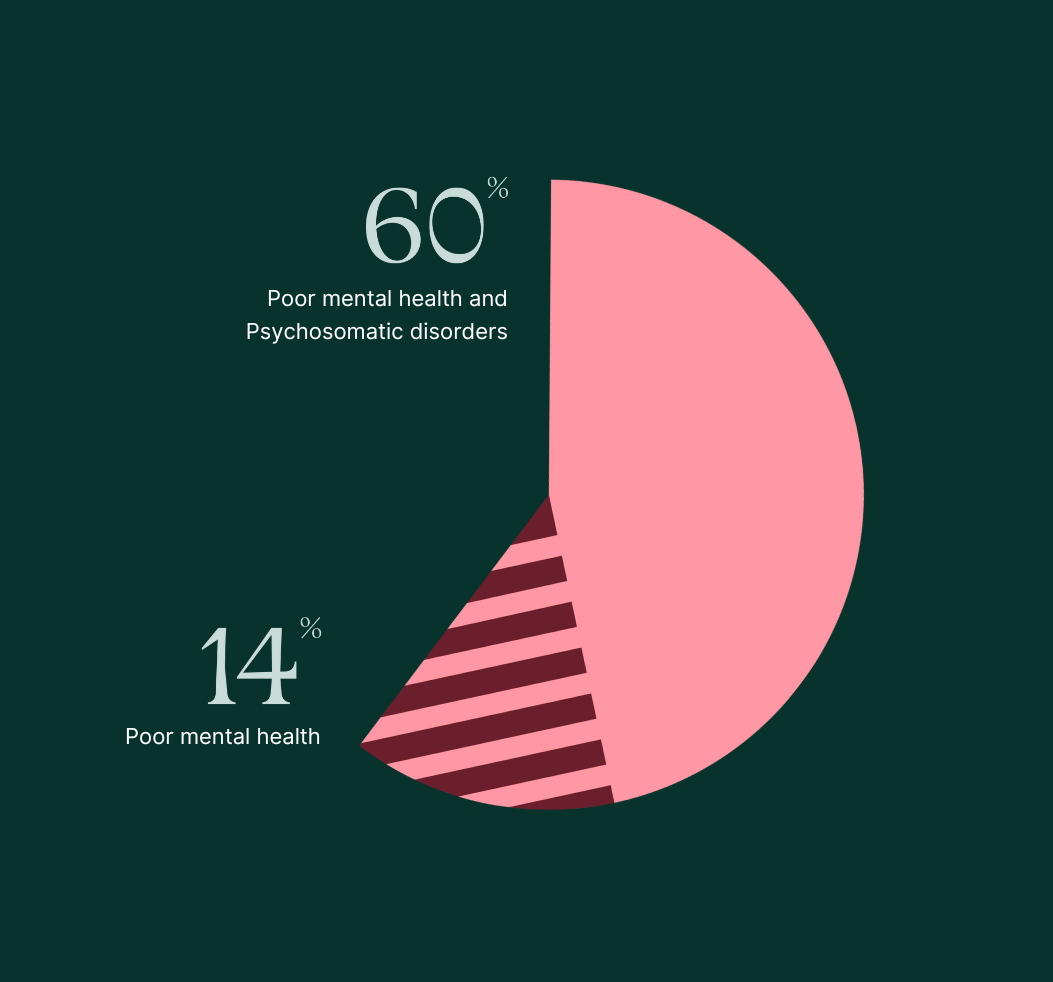

Reducing disability claims.

Poor mental health accounted for 14% of all income protection claims* during 2015 and 2020.

With an average claim duration of four and a half years. Adding in psychosomatic disorders this number rose to 60%.

Investing in preventative and effective treatments will be essential to reduce the number of disability claims related to mental health.

Contact us to learn more.

*I.e. insurance covering non-permanent disability.

Contact usMental illness is the fastest growing disability claim.

We help you address and manage mental health challenges in the workplace, building a healthier and more sustainable work environment together.

Contact us